Dear Very Important Philatelist (UPA V.I.P.),

Do you remember President Trump’s announcement of the instigation of tariffs being paid by United States residents upon their worldwide imports? I do.

In reality prior to President Trump’s dramatic announcement, our stamp collector clients in other countries were already paying non-recoverable import taxes (tariffs).

Countries such as Australia and Canada(sometimes), also New Zealand … and certainly collectors residing in almost all countries in the European Union (E.U.).

In a sense the USA was ‘late’ to the import-taxation tariffs ‘game’ (the question of tariffs was already brewing elsewhere but had not boiled over).

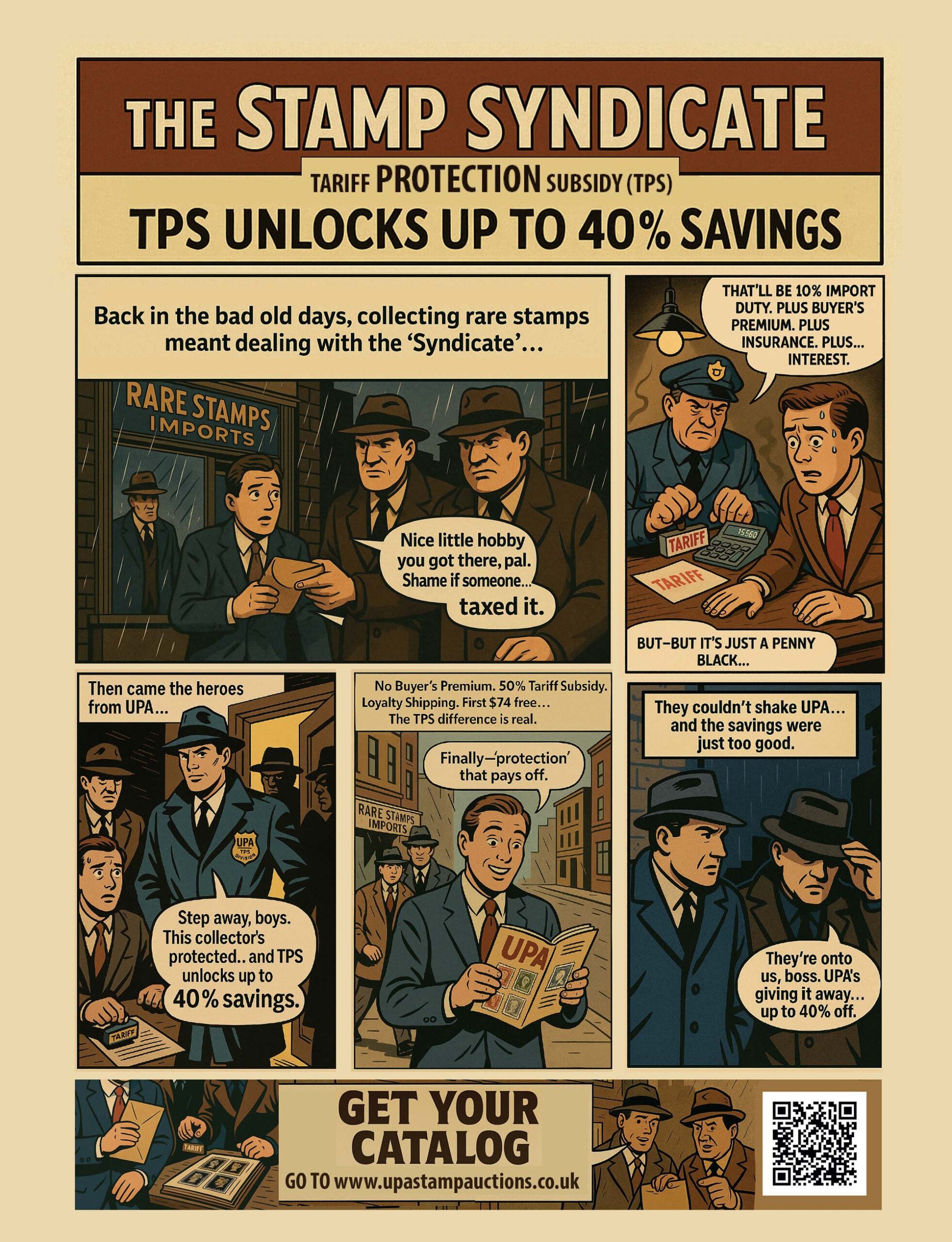

Admittedly, we have presented UPA’s TPS – Tariff Protection Subsidy, in an engaging ‘US inspired’ cartoon advertisement … but the point is (and it all comes back to money), all auctions, even eBay exports from the UK to successful overseas bidders are increasingly being charged by their Government (Post Office representative) import TAX (tariff) upon delivery.

Tariffs charged vary country by country, but generally range between (occasionally zero, to 5% up to as much as 20%).

The average import tariff seems to be 10%. Of course, you may hardly notice the imposition when buying stamps in UPA auctions, because UPA offers No Buyer’s Premiums, replete with unique UPA reducing-reserve price system … but in other auctions imposing 24% Buyer’s Premiums, shipping and insurance, very soon your £100 ‘hammer price’ Invoice may have ‘morphed’ by 40% to £140=. Factor in an additional tariff charge, it is easy to see the adverse impact upon other auction houses already ‘groaning’ with EXTRA unrelated premiums and charges.

For those auctions, the bidder-withdrawal ‘tipping point’ may have finally been breached.

Obviously then, tariffs threaten international trade. We will never order another stylish tablecloth direct from Italy to be charged £35 import (tariff) tax including £15 fee for the Post ‘person’ to collect the tax upon delivery.

UPA auctions sell to stamp collectors and dealers in some 42 different countries. Our exports to other countries may account for between 20% to 25% of our total sales.

It follows that we need to export stamps in order to be a truly International Auction. Further, we cannot permit tariffs (right or wrong) to undermine our International Stamp Auction Business Model.

So what has the Team come up with?

How does UPA’s unique Tariff Protection Subsidy (TPS) work ?

To Summarise: UPA subsidises up to 50% of tariffs paid, to a maximum 5% of the prices paid for auction lots. Subsidy only payable upon receipt/sight of payment documentation /receipts issued by the tax collecting authority, TPS to be taken in the form of auction-credit only.